Accurate payroll processing is an essential and valuable asset for any business. However, in the Philippines, many teams still struggle with limited resources and outdated systems. These lead to manual errors, inaccurate time tracking, and inconsistent attendance records that disappoint both the management team and employees, causing them to feel frustrated and demotivated, impacting overall productivity and workplace morale.

Businesses are set to redefine their payroll operations with Fareclock to create a more transparent, efficient, and motivating workplace for everyone. By seamlessly connecting attendance data to Fareclock’s built-in payroll tools, businesses ensure that every payout is accurate, on-time, and compliant with the regulations of the Bureau of Internal Revenue (BIR) and Department of Labor and Employment (DOLE).

Why Fareclock is an Important Tool in the Philippine Workplace

- Compliance Made Easy – Ensure full compliance with BIR and DOLE regulations by incorporating accurate documentation, automated deductions, and fair pay calculations that eliminate legal and audit risks.

- Reduced Ambiguity in Attendance and Pay – Real-time attendance tracking and mobile access to total worked hours remove confusion and miscommunication over time logs and pay.

- Timely and Accurate Payroll Processing – Deliver on-time, error-free payouts to strengthen employee trust, company morale, and overall workplace efficiency.

- Enhanced Security and Fraud Prevention – Track, verify, and validate attendance data to prevent buddy punching, time fraud, and inaccurate logs.

- Ease of Use and Scalability – Scale your business effortlessly with Fareclock’s user-friendly, adaptable solutions.

- Local Adaptability – Align your payroll settings to suit different operational needs that comply with local labor laws.

- Affordable, Cloud-Based, and Reliable – Fareclock is a cost-effective, cloud-hosted platform with a strong data security and dependable local Philippine customer support.

How Fareclock Automates Payroll for Different Business Needs

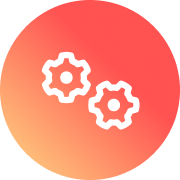

- Mobile Time Tracking – Management leaders and employees can clock in and out using their personal mobile devices for accurate attendance recording.

Preview Feature: Worker Start Window (Left), Home Screen (Center), and Map View (Right)

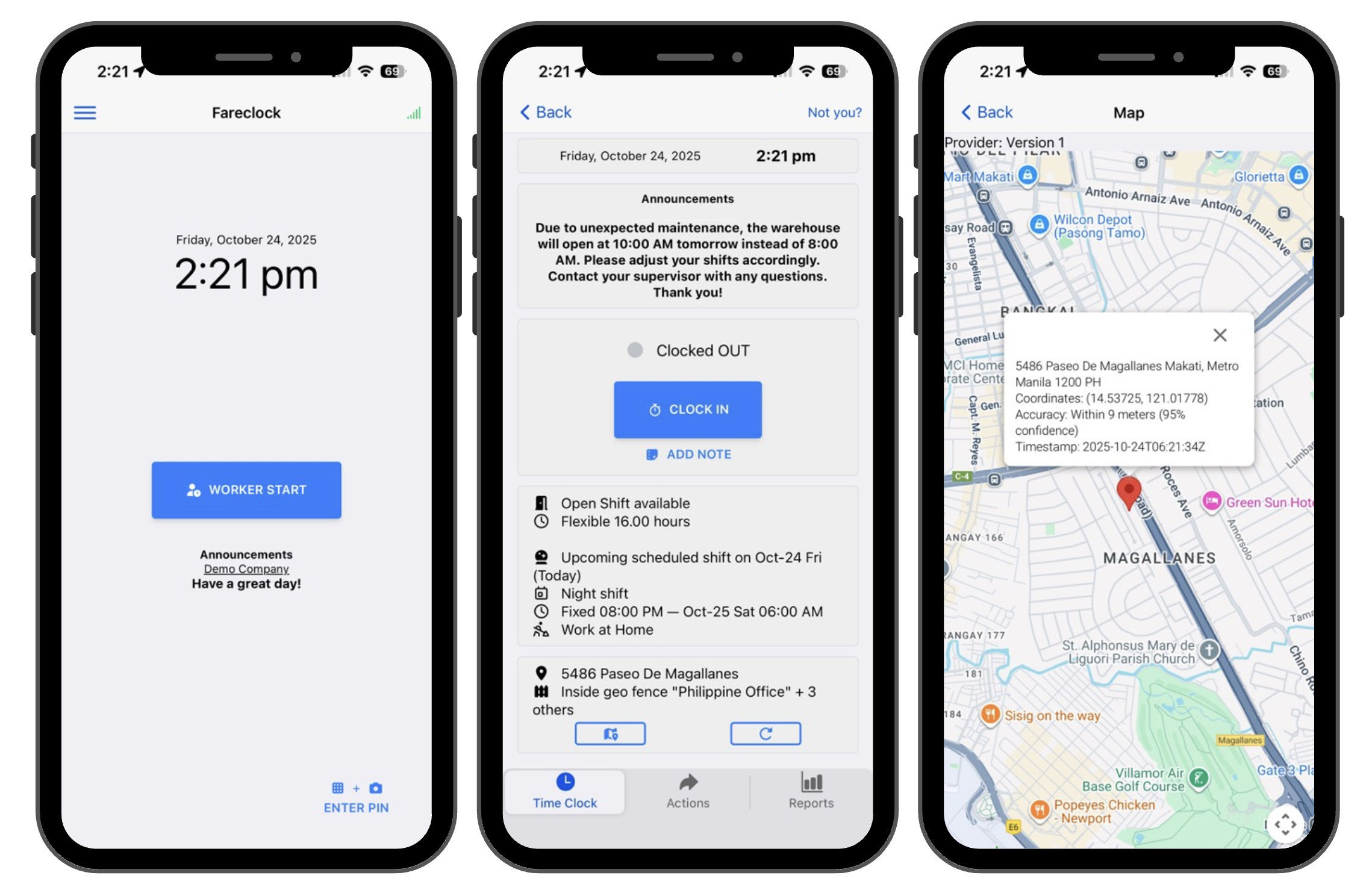

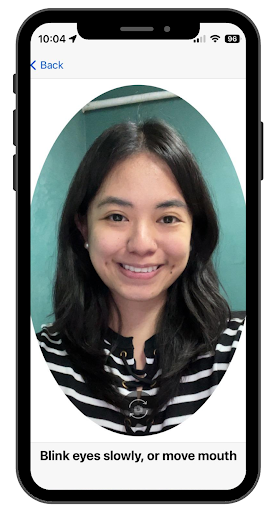

- Facial Recognition & GPS Verification – Advanced facial recognition and location tracking verifies that authorized employees are present at their designated job sites.

Preview Feature: Facial Recognition on Mobile

Preview Feature: Live Location Tracking

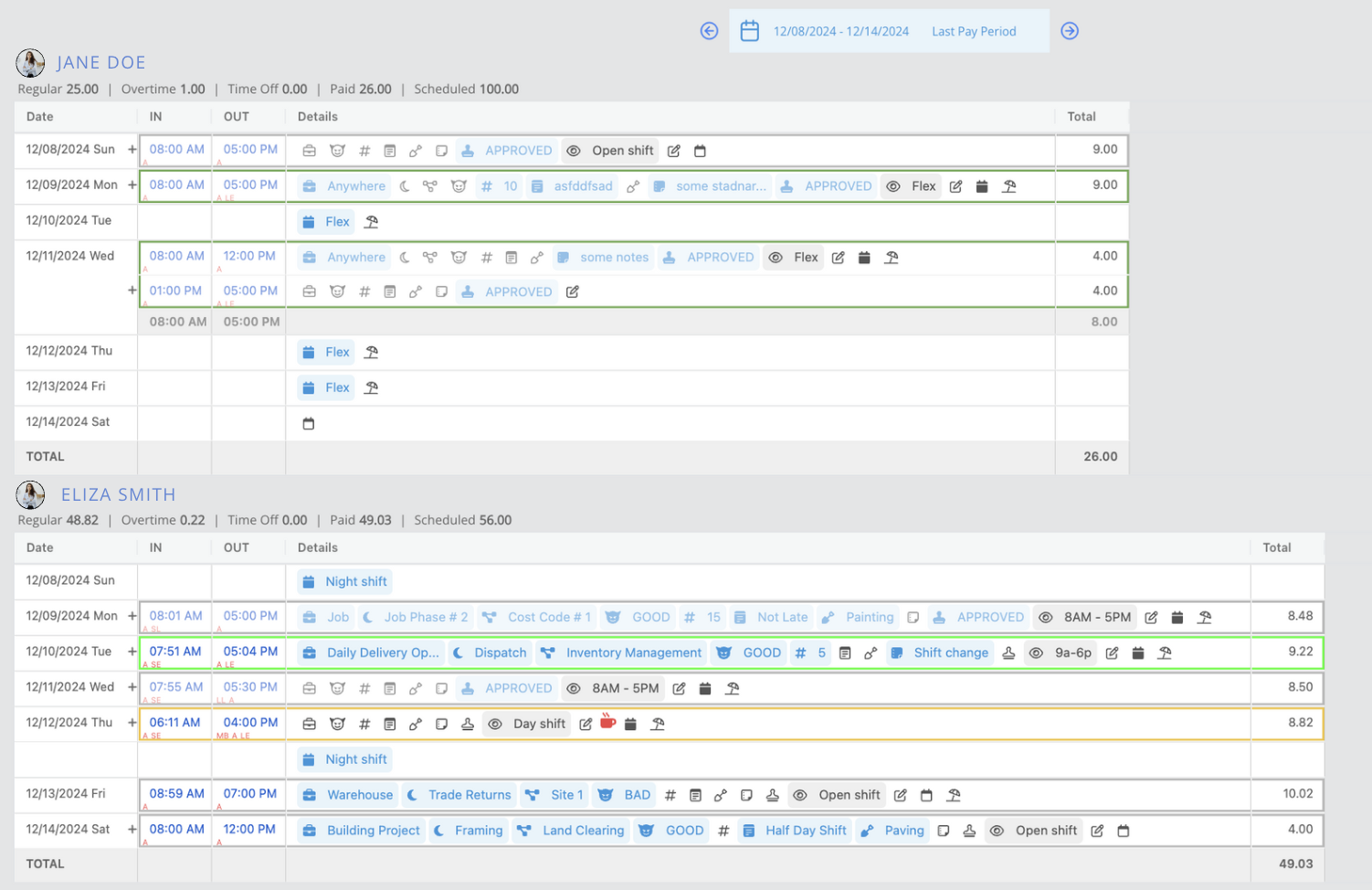

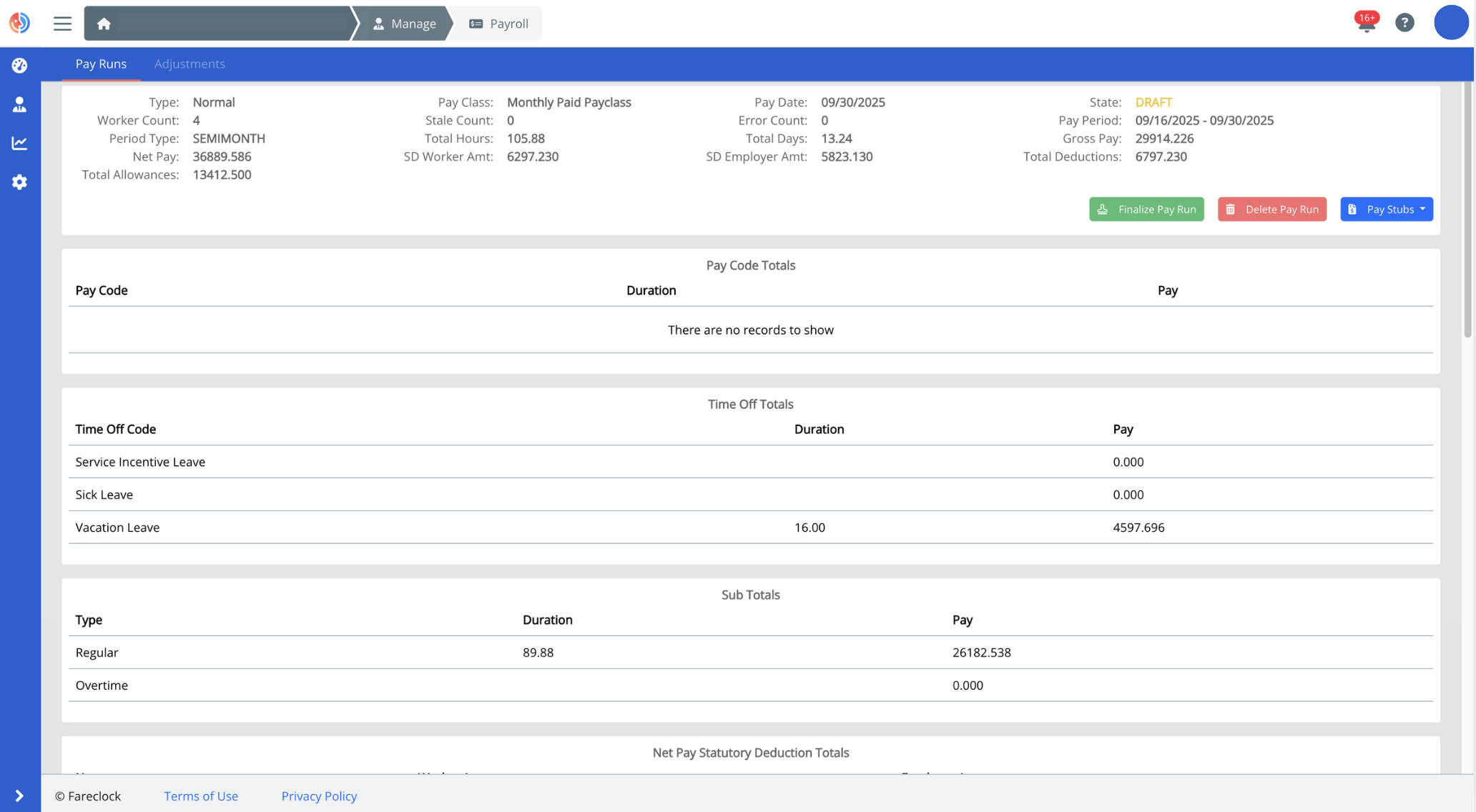

- Automated Data Synchronization – Attendance data is instantly synced with Fareclock’s payroll tools that help generate accurate and complete attendance records and shift summaries.

Preview Feature: Timecard Editor on Administrator Console

Preview Feature: Drafted Pay Run Sample (1)

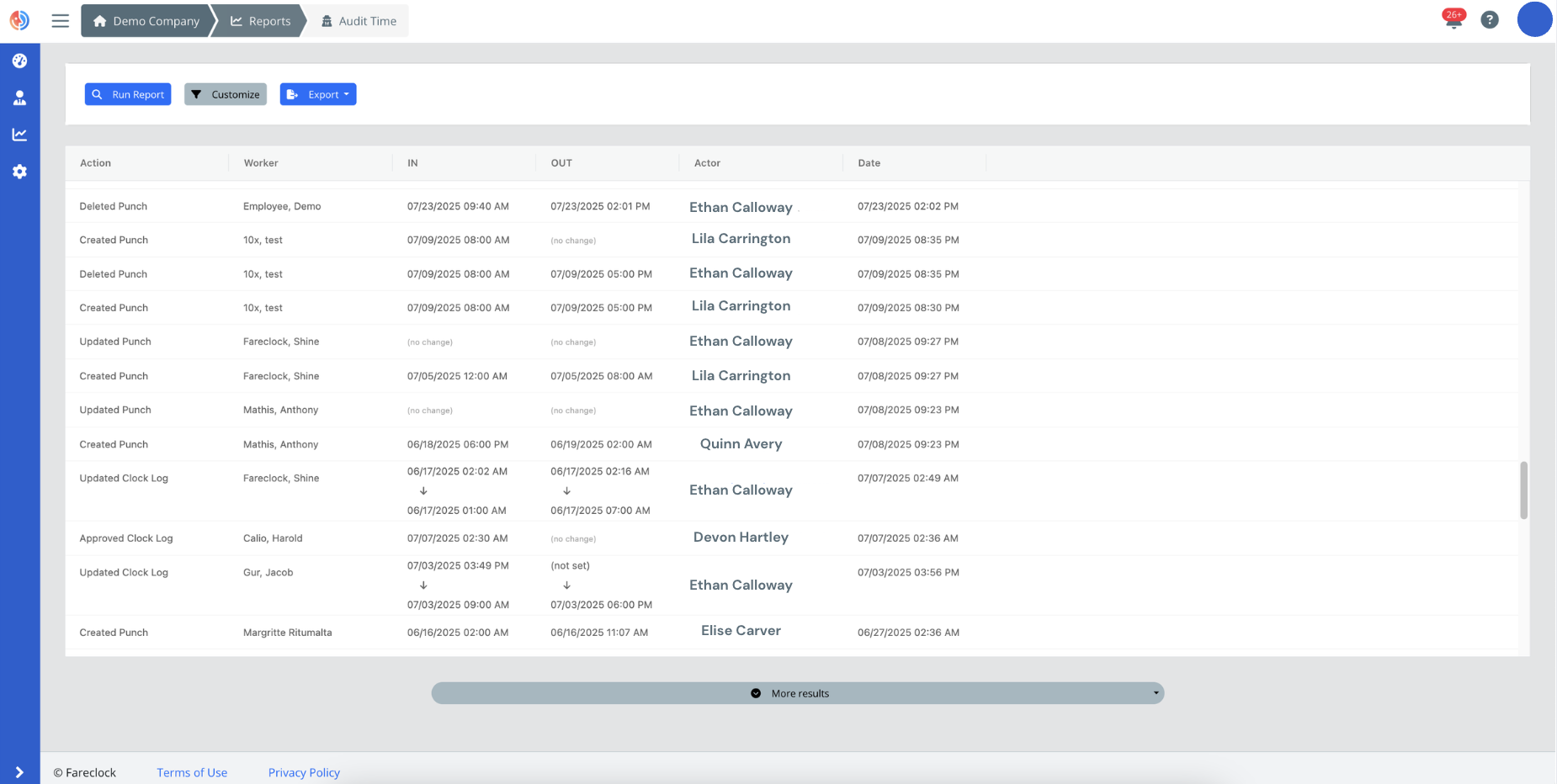

- Audit Trails & Transparency – Detailed audit time reports maintain data integrity to ensure records are tamper-proof and accurate.

Preview Feature: Audit Time Report Sample

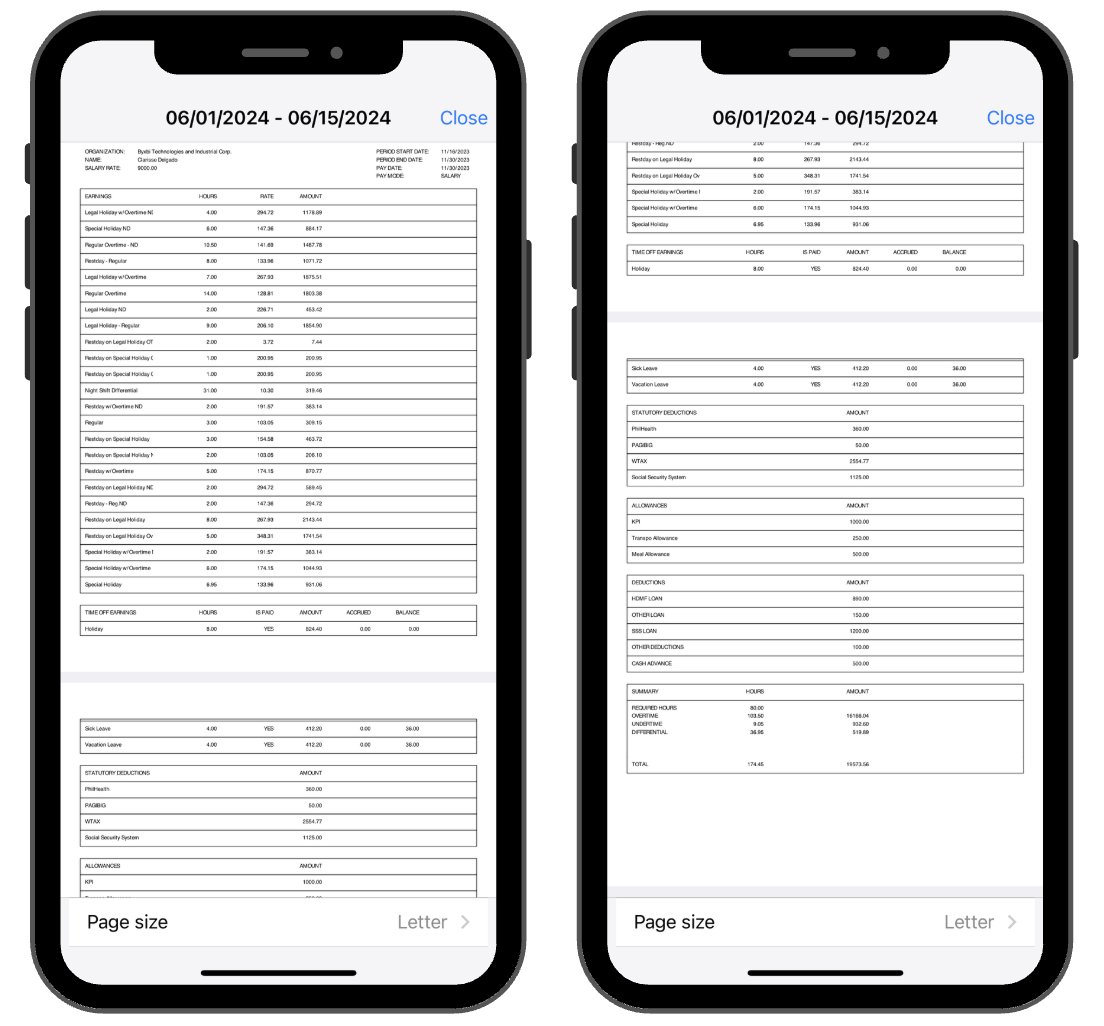

- Mobile Payslip Access – Employees can view and download their payslips anytime on their Fareclock mobile application.

Preview Feature: Worker Worker Paystub Access on Mobile

Redefine your Payroll Process with Fareclock

Effective payroll management is the cornerstone of every dynamic and successful workplace. By embracing modern, data-driven solutions, Fareclock offers a competitive advantage to Philippine businesses by offering seamless digital timekeeping and reliable payroll integration that bring accuracy, transparency, and fairness across an organization.

Contact Fareclock’s official Philippine business partner, Byxbi Technologies, to discover how Fareclock will help your business meet your payroll needs and demands that align with local standards!