Net pay is a crucial aspect of payroll processing. Thus, ensuring a correct calculation and a timely payout of net pay is vital for employee satisfaction and legal compliance.

In this article, we’ll look into the key components of net pay, the deductions that impact it, Fareclock’s net pay calculation tools, and the best practices for accurate payroll processing.

What is net pay?

An employee’s net pay is the amount they take home after all deductions are subtracted from their gross pay, which is the total amount earned before any deductions. Several deductions can impact an employee’s net pay based on local, state, and federal regulations, and company policies. Here are some common deductions you may encounter:

- Federal income tax – This deduction funds federal government programs. The 2025 federal income tax has seven tax brackets between 10% and 37%, depending on the taxpayer’s total income.

- State income tax – Many states impose income taxes, and the amount withheld depends on the employee’s income level and state of residence. Seven states (Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming) do not impose any state income taxes.

- Local taxes – Certain cities and counties may impose additional taxes deducted from an employee’s paycheck.

- Social Security tax – A tax applied through the Federal Insurance Contributions Act. It funds Social Security benefits and is split between the employer and employee.

- Medicare tax – This tax is shared by the employer and employee, and funds for Medicare benefits.

- Health insurance premiums – If an employer offers health insurance apart from Medicare, a portion of the premium may be deducted from the employee’s paycheck.

- Dental insurance premiums – Regular health insurance typically doesn’t cover dental, so it’s not uncommon for some employers to offer dental insurance coverage, which may be deducted from an employee’s paycheck.

- Retirement plan contributions – If an employee participates in a retirement plan, such as a 401(k), a portion of their paycheck may be deducted for contributions.

- Union dues – Employees who are labor union members may have union dues automatically deducted from their paychecks.

- Child support or garnishment orders — Court orders may require certain deductions from an employee’s paycheck, usually related to domestic situations.

What factors affect net pay calculations?

Several factors influence the calculation of net pay:

- Overtime pay – This is typically calculated at a premium rate, such as time and a half or double time, and must be accurately accounted for in payroll calculations.

- Bonuses and commissions – These computations may not be the same every time and may be dependent on internal policies. Bonuses are also subject to either a flat 22% federal withholding rate or a withholding amount based on the employee’s marginal tax rate, which the employer decides upon.

- Employee status – The withholding tax rates and other deductions may vary depending on whether an employee works on a full-time, part-time, or contractual basis.

- Marital status – Married couples may receive several tax benefits, including a lower tax rate, higher combined gift tax limits, exemptions, and more. These benefits may vary from state to state.

- Number of dependents – Certain states provide tax exemptions for eligible dependents.

- Changes in employment status – Changes in employment status, such as promotions, demotions, or job changes, affect an employee’s monthly take-home pay.

- Changes in personal circumstances – Marriage, divorce, or the birth of a child, can impact withholding tax and other deductions.

What are Fareclock’s Net Pay calculation tools?

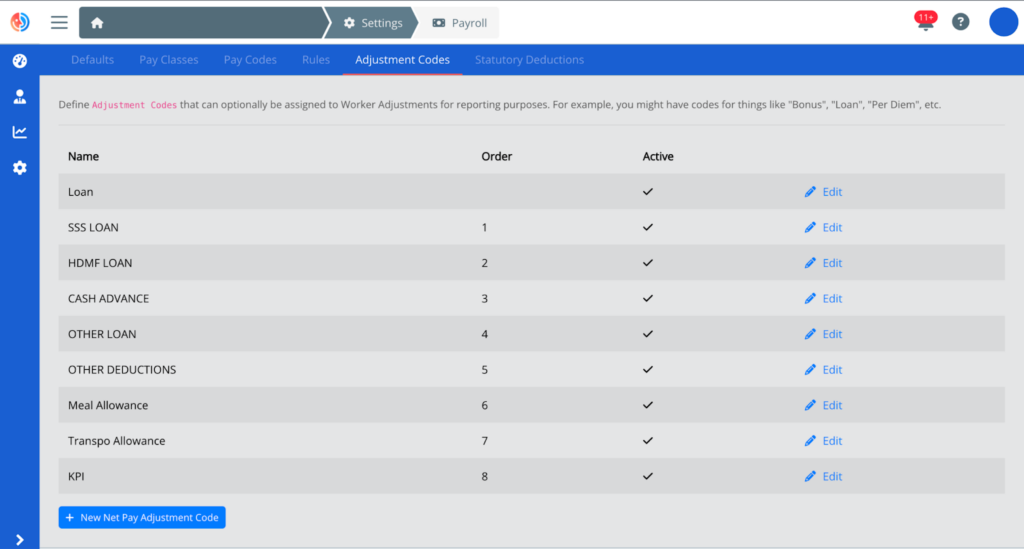

- Create and Manage Net Pay Adjustment Code Settings that apply to your business. Adjustment codes may be allowances (meal, load, transportation, etc.) or deductions (cash advance, loans, etc.).

In focus: Sample List of Adjustment Codes applicable to a business

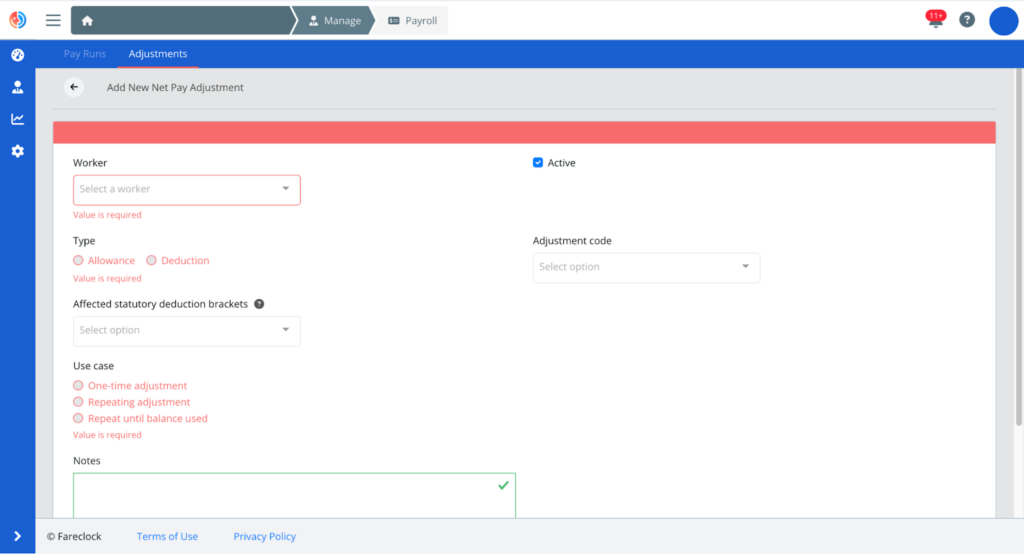

In focus: Add a New Net Pay Adjustment

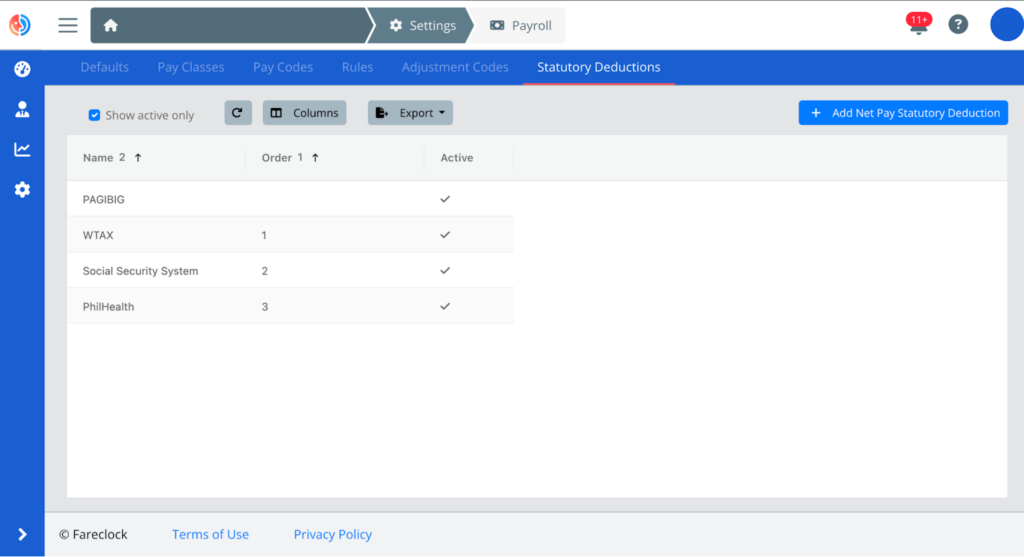

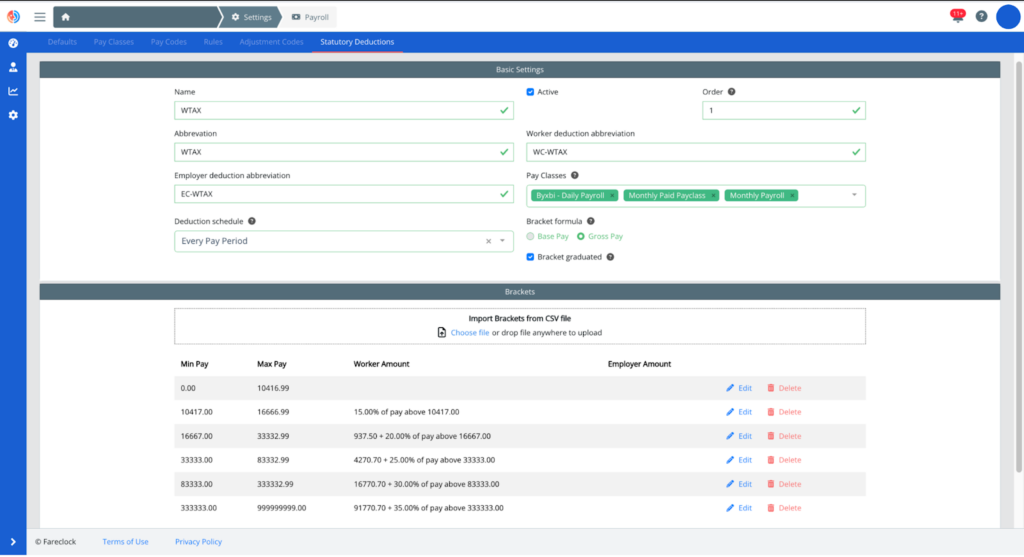

- Add and Manage Net Pay Statutory Deductions that apply to your business according to laws and regulations. A deduction bracket guide may be uploaded or imported.

In focus: Sample List of Statutory Deductions applicable to a business

In focus: Add a New Statutory Deduction

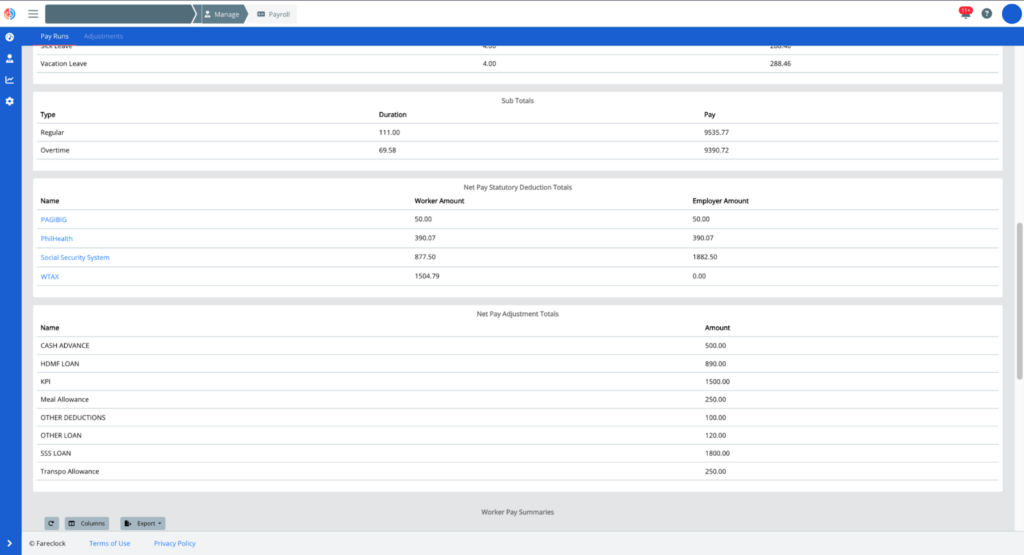

- View and Manage Pay runs or worker pay summaries that provide a breakdown of time off totals, Net Pay Statutory Deductions, and Adjustment codes (allowances or deductions) on a worker’s net pay.

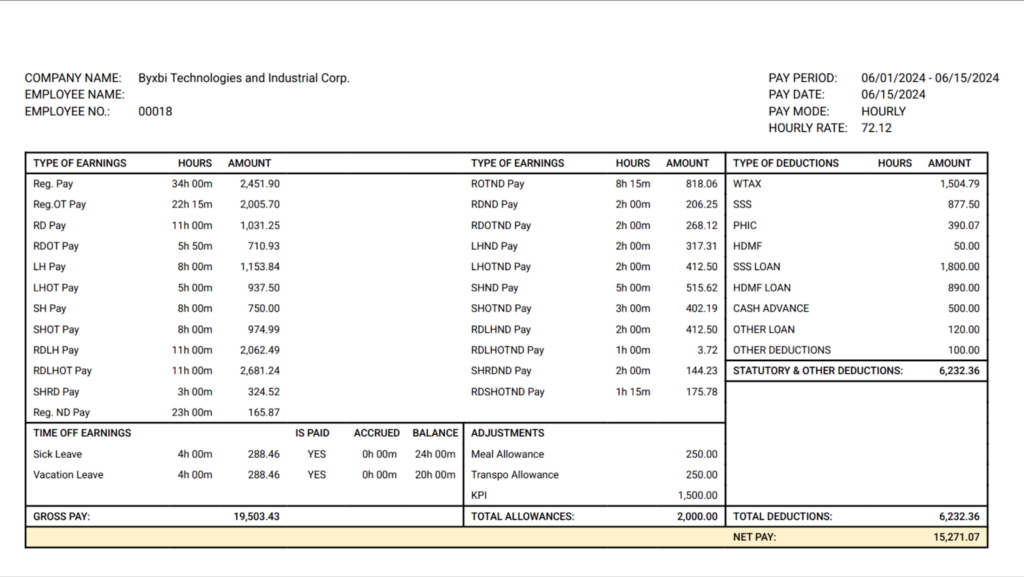

- Provide a detailed record or document of a worker’s total earnings and deductions for a specific pay period.

In focus: Worker Pay Stub

What are the best practices for accurate payroll processing?

To ensure accurate net pay calculations and avoid costly errors, consider the following best practices:

- Stay updated on tax laws — Check for any tax-related updates regularly and attend tax seminars. Many of these seminars are now accessible via online live streams or video calls.

- Train employees – Updates to tax laws may involve new recording procedures, making additional training for your payroll team a necessity.

- Utilize payroll software – Invest in reliable payroll solutions like Fareclock to automate calculations and reduce errors.

- Verify employee information – Ensure that employee information, such as address, marital status, and number of dependents, is accurate and up to date.

- Regularly review payroll processes – Conduct regular reviews of payroll processes to identify and address any potential issues.

- Consider outsourcing – If you have a complex payroll system, consider outsourcing payroll processing to a specialized provider.

Ensure your team’s payroll is always correctly recorded and transmitted by partnering with Fareclock’s payroll solutions. Contact us today to learn more about our services.